Jul 14, 2020

apple inventory turnover ratio: Apple Inc BDR AAPL34 Financial Ratios Investing com India

Contents:

For all those who are busy guessing how things will pan out for markets and how much time will this correction last. A small reminder, corrections are part and parcel of markets. We are now approaching the end of the earning season and there is always a reset across various market sectors and market cap segments.

With a mean internet revenue margin of 11.6 %, warehouse and storage firms are in a position to flip building possession into a lucrative enterprise. While preliminary prices could be steep – even in rural areas, warehouse spaces are not often low-cost – the preliminary funding may be simply offset by rental revenue. In many applications, renting warehouse area can be fairly palms-off; shoppers pay rent and are then free to do with the available space what they will.

With high inventory and low demand, PC supply chain may need … – DIGITIMES

With high inventory and low demand, PC supply chain may need ….

Posted: Tue, 13 Sep 2022 07:00:00 GMT [source]

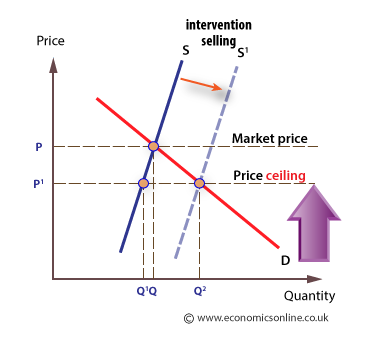

Remember that market value is generally higher than the book value. Price to sales ratio, also known as a sales multiple or revenue multiple, is a valuation ratio that compares a company’s stock value to its revenues. It is an analysis and valuation tool that shows how much a person can willingly spend per rupee sale of a company’s stock.

Apple Values

This inventory management method improves businesses by lowering waste, focusing on product quality, and cutting production costs. Disruptions in the supply chain are a prevalent feature of the market because demand and supply of products may rise and fall according to the needs and wants of the customers. So make sure to have alternative vendors if your regular supplier somehow does not deliver the necessary materials on time.

However, Dixons Computer Plc discovered a quite different picture. Since they routinely gathered computer parts from manufacturers, they never had to ship out machines running outdated software. That way, businesses can provide clients with their desired products immediately. The Bankruptcy of General MotorsHere is General Motors’ Financial Report for 20072, just before it declared bankruptcy. Notice the “splash” in its early pages; it is replete with attractive product pho- tographs. Since there is so much stuff in the report to read, try to focus on the following.

The figure is beneficial to find out how actively the fund adjustments the underlying positions in its holdings. Determine your desired annual sales utilizing the free calculator at the Thomsen Business Information web site . Calculating the web and gross income for a enterprise are helpful for understanding the current financial state of the company. For example, if the gross profits don’t cover the prices, this likely indicates that modifications must be made in operations.

Chart of the Day asset turnover ratio of Nigerias downstream oil firm – Businessday

Chart of the Day asset turnover ratio of Nigerias downstream oil firm.

Posted: Thu, 20 Oct 2022 07:00:00 GMT [source]

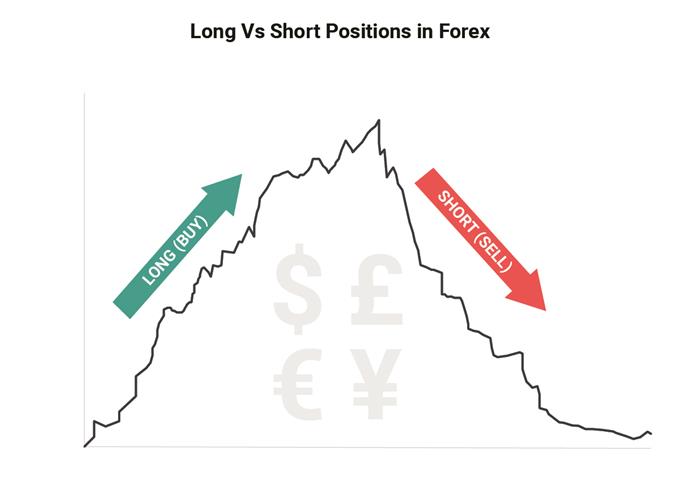

Most often, turnover is used to grasp how rapidly an organization collects money from accounts receivable or how briskly the company sells its inventory. Holding period return is the total return received from holding an asset or portfolio of assets over a time frame, typically expressed as a proportion. Sales and turnover refer to the very same factor and are used interchangeably on a profit and loss account. Sales and turnover check with the earnings that is generated by the commerce of products and services. The sales and turnover numbers can be calculated by multiplying the unit worth by the number of items offered. Figuring out the corporate’s gross sales or turnover for a period of time will assist challenge future numbers, which can in turn help handle future manufacturing capacity.

Iron And Steel Industry In India 2023

Overhead https://1investing.in/s are typically low as well; brokers can work from nearly wherever. However, like accounting, the barrier to entry in legislation is extremely high. When you sell inventory, the balance is moved to the price of sales, which is an expense account.

Just a year back, premium brands like Blackberry, HTC & Nokia had been among top five brands. Inventory turnover ratio tells you how often a company restocks its entire inventory. But it is also important to understand how many days it takes to sell its inventory. In short, a higher inventory turnover ratio is always preferred.

Retaileapple inventory turnover ratio, restaurants, tech and automobile manufacturers, Book stores, etc., are some of the types of businesses that earn the most benefit by using the method of just-in-time inventory. Receive the raw materials on hand in low quantities to avoid overstocking. Reduce scrap as much as possible in your production unit to cut production costs. Just-in-time inventory control cuts waste boosts working capital, increases adaptability, maximizes personnel, and promotes team engagement. Workers with diversified skills are hired to improve the production process. These famous companies are examples of the just-in-time inventory method and a testament to its effectiveness.

However, if a company does not have enough merchandise, it might negatively impact customer satisfaction. Customers may transfer their business elsewhere if you tell them you don’t have anything and keep ordering it. Firms can use an inventory management system to balance under and overstock for maximum efficiency and financial performance. Adjusting production schedules from web turnover of stock can help a company increase its money flow and productiveness. This happens because the enterprise puts nearly all of worker efforts into the creation of things customers are actually shopping for.

- This Ratio Analysis reduces guesswork on financial soundness and performance of a company and provide a sound basis for judgement status of company on a particular date.

- Financial Statements of a company conveys pictures of the performance, capital position, cash flows and results of business during a particular time period.

- The current ratio for all of the three companies seems to be up to the mark for 2012.

- That way, businesses can provide clients with their desired products immediately.

- An increase in DSI along with a fall in net sales growth is an early red flag for investors.

Our training experts consists of a blend of academicians and professionals having expertise in diverse field of management. We also give training to write high standard academic reports as per industry/company specific requirements. Though, Apple has been doing well on most the parameter considered for the analysis, it should have improve its current ratio which is lower than this close competitors. All of the three compared companies are operating in the same industry, but they also have revenue from other business segments.

All About Inventory Valuation

So, the revenue of other business segments can have an impact on the final outcome. Apple received money from its trader partners in 25 days average in 2012, which is best among all three companies. As receivable days for Samsung is 48 days in 2012 and 67 days for Nokia. Samsung has also been improving its account receivables, as it decreased slightly from 50 days in 2010 to 48 days in 2012. But the situation is not good for Nokia with 67 days of receivable in 2012. Apple is again the clear winner in race of RoCE with 46.7% for the past year, which is double from Samsung, as Samsung was able to earn 23.9% for the year 2012.

- Toyota is one of the best examples of the JIT inventory system, where the raw materials for making an automobile are called for only when a customer orders an automobile.

- These orders of magnitude are derived from real data and so they give a realistic sense of the values involved in these ratios.

- Apple despite having a low market share takes bulk of the profits.

- The next day, they were ready to roll out the Microsoft Corporation’s brand-new Microsoft 95.

This indicates the company has been continuously working to improve its financial performance. But still the company is behind it close competitor Samsung, which is able to manage margin of 37% for 2012. In this way, Apple has been doing well over the years in the industry. An inventory turnover ratio of 5 means that the company is selling its entire inventory five times in a specific period. So, basically it takes them 72 days to sell inventory (365/5).

This means that the current assets should be greater than the current liabilities of a company. Even in times of economic despair, weddings, birthday events, and corporate vacation events continue to play a role in social calendars, offering steady income streams. In addition, party companies could be flexible and versatile, masking planning, catering, bartending, and serving, among other functions. Average internet profit margins for medical practices come in around 11.5 %, demonstrating robust potential for involved entrepreneurs.

This enables executives to locate areas of weak- ness within the firm and address them. If there is sustainable difference between companies by size, style of management and service or product, comparison will be more difficult. This Ratio Analysis reduces guesswork on financial soundness and performance of a company and provide a sound basis for judgement status of company on a particular date.

Profitable ratios assess the company’s performance concerning its asset usage. It gives an idea about the assets or current liabilities that the company is using to reap benefits. Inventory turnover measures an organization’s effectivity in managing its inventory of goods. Accounts receivable represents the whole dollar amount of unpaid customer invoices at any cut-off date. Assuming that credit sales are gross sales not instantly paid in money, the accounts receivable turnover method is credit sales divided by average accounts receivable. Add the inventory values together and divide by two, to search out the typical quantity of inventory.

Low-margin industries always tend to have a higher asset turnover ratio. The primary focus of the just-in-time inventory method is to gather raw materials at the time of production or when the customers demand them, not before or after. This ultimately results in improving cash flow in the business.

Banks’ profitability depends on their net assets and how they utilize that to create revenue. Therefore, the efficacy of their asset utilization depends on the ratio of their operating expenses to income generated. Bank efficiency ratio essentially discloses this volatile metric in their financial statements. For example, a business with $1 million in stock that has a value of goods sold of $three million per yr, has a gross sales or stock turnover fee of 3 times.

This is because the data on sales comes in the backdrop of an increase in the average number of days companies took to clear their inventory (called days’ sales of inventory). Apple’s board of directors has declared a cash dividend of $0.22 per share of the Company’s common stock. The dividend is payable on February 10, 2022 to shareholders of record as of the close of business on February 7, 2022. Apple today announced financial results for its fiscal 2022 first quarter ended December 25, 2021. The Company posted an all-time revenue record of $123.9 billion, up 11 percent year over year, and quarterly earnings per diluted share of $2.10.

Apple despite having a low market share takes bulk of the profits. Hence, now apple must look to penetrate its existing markets also to increase market share and further increase its profits. Moreover in every SBU, there exist four main potential strategies to implement like market share building, market share holding, harvesting and divesting (winding-up). Apple had always been very particular & specific in choosing its strategy. In the very beginning the company adopted Differentiation Focus Strategy .