Jul 5, 2022

Global Trading News and Market Analysis

Contents:

When you are trading the news, you must evaluate the potential effect an economic indicator can have on a particular market. An economic calendar is a very important tool for any news trader, as its strategy is based on smaller a time frame. An economic calendar covers different financial events and economic indicators from all over the world and it’s automatically updated when new figures are released. If the prices of an exchange rate fluctuate rapidly in a short term, it is considered to have high volatility.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time.

But most trends reverse at some point, and a change in the underlying economics could be the first sign of this. A live account will give you access to Morningstar equity research reports and Reuters news headlines, which provide a wealth of information for all asset classes.. As with any trading https://day-trading.info/ strategy, there are always possible dangers that you should be aware of. News Traders should know in advance the daily and hourly support and resistance levels. The trade balance is analyzed by traders in order to measure the strength of the country’s economy in relation to other countries.

News & Analysis

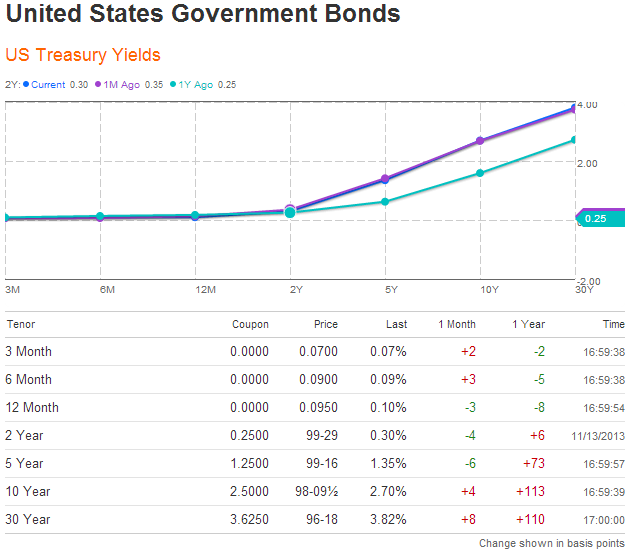

Gold dribbles around $1,920, after a zigzag session that initially refreshed the six-week high but ended the day without any major moves. The Gold price earlier cheered the softer United States Treasury bond yields before the improvement in market sentiment and a rebound in the bond coupons probed the XAU/USD bulls. USD/JPY upside looks to be fading; however, upcoming key economic data will pave the way forward. A one-touch option only has one barrier level, which generally makes it slightly less expensive than a double one-touch option. The same criterion holds—the payout is only made if the barrier is breached prior to expiration. This is a good option to buy if you actually have a view on whether the number will be stronger or weaker than the market’s consensus forecast.

The economy of a country has a direct influence on the evolution of the national currency. That is why it is important to know the events that can mark the evolution of a currency in one way or another, as well as their correct interpretation. Rothschild then sold stocks publicly on the London Stock Exchange thereby giving the market the false impression that Napoleon had won and prompting a substantial sell-off. He then privately bought as much stock as he could at the lower prices he had induced before the market eventually caught wind of the real news and rallied. This well-known adage refers to how the market often responds sensibly to rumors of an event, but it then corrects in a counter-intuitive manner once the news arrives and profit-taking sets in.

By Karen Brettell NEW YORK – The dollar hit a three-month month high against a basket of currencies on Tuesday after Federal Reserve Chair Jerome Powell said the U.S…. By Ambar Warrick Investing.com — The U.S. dollar hit a three-month high against a basket of currencies on Wednesday, tracking a spike in Treasury yields after Federal Reserve… By Peter Nurse Investing.com – The U.S. dollar edged lower in early European trade Thursday, but remained elevated as Federal Reserve Chair Jerome Powell again pointed to further… By Daniel Ramos and Monica Machicao LA PAZ – Bolivia’s government is battling to calm fears among savers and businesses about a shortage of dollars in the country, which…

- However, when you go to your trading platform to start selling the dollar, you see that the markets aren’t exactly moving in the direction you thought they would.

- While positive news creates buying opportunities, negative news normally leads to selling pressure, which can create the opportunity togo short.

- This means you’ll need to have a thorough knowledge of both news announcements and how they’ve affected markets previously before you trade.

- Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events.

Furthermore, news releases are set at pre-determined dates and times allowing traders enough time to prepare a solid strategy. Evaluating forecasts and being mentally prepared to execute the trade at the moment of impact of the news is a very difficult and risky task, as there is no guarantee that this strategy will work every time. That’s why a trader should mix news trading with his overall technical analysis system. Trading the news proactively means taking a position ahead of a news release. Many proactive news traders prefer to enter their orders around 20 minutes ahead of the data release.

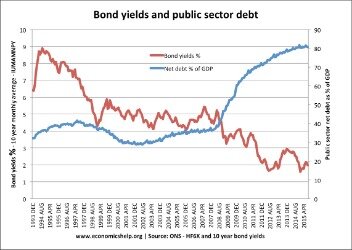

Forex News Trading & Fundamental Analysis

This analysis process can help a trader come up with a more accurate exchange rate prediction. NFP number and U.S. gross domestic product , for example, tend to provoke strong reactions in the forex market, especially if they deviate significantly from analyst expectations. Such numbers can provide opportunities for short-term news trading strategies. In general, the fall in the euro tracked the collapse in short-term bond yields in the eurozone. In particular, news trading requires expert fundamental analysis skills, as you will need to understand how certain economic announcements can affect your positions and the wider financial market.

This generally means that the trader has researched the economies of both nations thoroughly. This gives them the background to know immediately whether the impact on the currency pair’s exchange rate should be positive or negative. Since the dollar is one side of many currency pairs, U.S. economic releases tend to have the most pronounced impact. Read more about kvb kunlun review is kvb a scam or legit broker using fundamental analysis in the consideration of external factors as part of your news trading strategy. Because the forex market is very volatile during important news events, many forex brokers WIDEN the spread during these times. At the start of each trading day, you must verify the economic calendar for the most important releases of economic indicators.

Seasonal forex trading news and impacts tend to be seen in energy and agricultural commodities, but less so for precious metals. The table below shows some of the main resource currencies and the commodities that affect them. These can be used by traders as a sort of forex news trading signal, as it can help to predict where the price of the currency is headed. Some experienced traders definitely make money in forex news trading, but they have usually done the required research and acquired the experience needed to trade news releases profitably. Keep in mind that substantial slippage can occur on stop orders left during major news releases. Slippage can result in significantly worse exchange rate fills because of the sharp movements and lack of liquidity often seen in the forex market at such times.

How to trade FOMC meetings

Forex market’s biggest profit opportunity is news trading, as it can produce instant profits in a very short period of time. But at the same time, news trading is also very intimidating and many traders avoid to trade the news, exiting positions before major events or moving their stops to break even. Another type of proactive strategy involves a trader establishing equal hedged positions on both sides of the market ahead of the data release. Basically, a hedge trader “legs” or trades out of the two opposing positions at different times in the volatile market that can ensue after the data release happens. The news trader using this strategy aims to take a smaller loss on one side of the position than their gains on the profitable leg.

This chart shows activity after the same release as the one shown in Figure 2 to show how difficult trading news releases can be. On Nov. 4, 2005, the market had expected a payroll increase of 120,000 jobs, but instead the U.S. economy gained only 56,000 jobs. The disappointment led to an approximately 60-pip sell-off in the dollar against the euro in the first 25 minutes after the release. More losses could be on the way if investor concerns about Credit Suisse are not dealt with by the authorities quickly.

INSTITUTIONAL BANKS

The cost or benefit from these rollovers can affect whether traders prefer to be long or short a currency pair overnight. If the news release requires a few days or weeks to materialise, your trading positions may be open over several days. This brings overnight risk and may require you to pay additional holding costs. Therefore, traders should ensure that they have sufficient funds in their account to cover these costs.

Trading forex news before the release is beneficial for traders looking to enter the market under less volatile conditions. In general, traders who are more risk averse gravitate towards this approach looking to capitalize on the quieter periods before the news release by trading ranges or simply trading with the trend. Could place traders on margin call if there isn’t enough free margin to accommodate this. These realities surrounding major news releases could result in a short trading career if not managed properly through prudent money management such as incorporating stop losses or guaranteed stop losses . The currency market is directly influenced by national and international economic and political developments. The important economic events cause changes in the demand and supply ratio on the foreign exchange market.

FOREX-Dollar slips after ECB rate decision, Fed hike seen – Yahoo Finance

FOREX-Dollar slips after ECB rate decision, Fed hike seen.

Posted: Thu, 16 Mar 2023 19:51:40 GMT [source]

The release of these numbers, as well as important geopolitical news, can often exert a strong influence on a country’s currency. Because these news events can move exchange rates significantly, it pays to keep a keen eye on what news is being released and when. How Central Banks Impact the Forex Market Discover how policies and interest rate hikes of central banks impact forex and trading decisions. This means that you can handpick the currencies and economic releases to which you pay particular attention. But, as a general rule, since the U.S. dollar is on the “other side” of 90% of all currency trades, U.S. economic releases tend to have the most pronounced impact on forex markets. Our Morningstar equity research reports are updated regularly with new information about company fundamentals.

There are two barrier levels, but in this case, neither barrier level can be breached before expiration—otherwise the option payout is not made. This option is great for news traders who think that the economic release will not cause a pronounced breakout in the currency pair and that it will continue to range trade. Figure 1 lists the approximate times of the most important economic releases for each of the following countries. These are also the times that players in the forex market pay extra attention to the markets, especially when trading based on news releases. As discussed, our online trading platform, Next Generation, releases regular news and analysis articles for all financial markets. We also provide fundamental analysis reports from Morningstar, as well as market commentaries and updates from Reuters news on our news and insights section of the platform.

A straddle trade involves taking both sides of the price action, on a short term. For example, if you trade the U.S. dollar against the Japanese yen or USD/JPY currency pair, then you would need to follow economic events in both the U.S. and Japan. Similarly, if you want to trade EUR/USD, then you would need to look at the economic pictures in the Eurozone and the U.S.

Forex Friday: NFP, GOLD, Guppy and Bitcoin

In general, news that has a significant impact on individual company shares may not have a major impact on currencies. Stock market news that has little or no impact on currencies includes earnings reports, management changes, mergers and acquisitions and partnerships. Therefore, it may be easier for some to make more reliable forex news trading predictions on how the market will perform. However, if a company releases a report with considerably lower financials than expected, this can cause a rally for traders to short the stock as its value is decreasing. Traders can perform company analysis before deciding whether to invest in a stock.

Meanwhile, the stability of the pound sterling relative to the euro suggests that investors have no similar concerns about UK banking stocks. At the same time, shares of the main British banks fell in the region of 4%, which was much less sharp than the names of the euro area. But reading the news for trading requires you to be able to make judgements about what will impact markets, and what won’t. The importance of prudent risk management cannot be overstated during volatile periods that follow a news release. Such erratic pricing has the potential to cause a huge spike in price that shoots through a stop loss in the blink of an eye, resulting in slippage. Buy the rumor, sell the news is a market belief that prices move in anticipation of rumors and profit taking occurs after the actual news is released.

Fundamental analysts routinely evaluate key economic factors for one country and compare them against those same factors for another country to arrive at a relative economic outlook. This assists them in making an exchange rate forecast for a currency pair that involves the two currencies of those two nations. You should remain cautious when leaving stop-loss orders ahead of important economic data releases. The abnormal order slippage often seen during highly volatile markets can result in your stop order being executed at an unexpectedly unfavorable rate on an extreme spike or dip just before the market retraces.